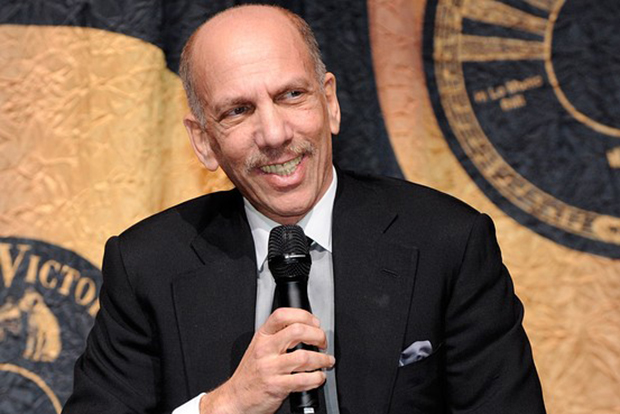

In recent months SFX Entertainment has acquired many platforms to promote the globalization of dance music, or as those at SFX now refer to it, electronic music culture. Led by music industry billionaire Robert F.X. Sillerman the reconstructed SFX company has made yet another purchase, Australia’s largest event promoter, the Totem OneLove Group. For one hundred percent of the company, those behind the Stereosonic Festival will receive seventy-five million dollars from SFX, sixty million in cash, and fifteen million in stock. Yes, stock; as of yesterday SFX Entertainment is now a publicly traded company with shares closing on Friday at eleven dollars and ninety cents. It’s a bag of mixed emotions currently with the future of major festivals being consolidated into the hands of a minority group.

Wednesday’s initial public offering (IPO) from SFX of twenty million shares, started at thirteen dollars a share. This brought in roughly two hundred sixty million dollars, and provided an overall evaluation of the company at slightly above one billion dollars. Using this influx of cash payable on October 15th, SFX will finalize the purchase of Totem and other pending purchases, again expanding the global label. With a market cap between seven and nine hundred million dollars, there is plenty of room for immediate growth.

Throughout the past year Sillerman and SFX have taken an aggressive approach towards protecting and advancing the companies interests. In February, the New York based corporation spent fifty million dollars on the purchase of Beatport, and a month later purchased a seventy-five percent stake in ID&T for ninety-seven million dollars. This immediately led to Tomorroworld venturing stateside. For the sake of a good run-on sentence, SFX will soon have controlling interests in Stereosonic, Tomorrowland/world, Sensation, Life in Color, Mysteryland, Q-Dance, Electric Zoo, Nature One, and MayDay just on the festival side, as well as all events promoted by Disco Donnie Presents, Made Event, EZ Festivals, German promoter i-Motion GmbH Events & Communication, and MMG Nightlife.

The magnitude of the company at this point is staggering and there are no signs of planned regression. Although potential negative externalities are vast, plentiful and often uncontrollable, Sillerman addresses these ‘Risk Factors’ in his filing with the Security Exchange Commission. He lists reasonable risks such as illicit activity leading to negative publicity or litigation, competitors, and the potential decline of ‘EMC’. In much greater detail the filing ultimately allows SFX to register as an “emerging company”, which limits the amount of taxes the company will have to pay. Good for them, if everything runs smoothly.

So far, many investment bankers seem disinterested in the IPO due to the lengthy list of imminent risks and circulating speculation about the lack of long-term profitability. If more events such as Electric Zoo are shut down then obviously SFX will lose money, but now, a similar tragedy will have an even greater financial effect. Hypothetically, imagine a major festival being canceled even for just a day. Stock prices are immediately effected and proving substantial profitability moving forward becomes even more difficult. If stock prices never fully recover, it could easily be the events that suffer. While it’s unlikely that SFX will ever have a major lack of capital, the liquid assets available now could easily evaporate and place certain festival leaders in a very precarious situation.

“Maintaining the strength of our festivals, events and online businesses will be challenging, and our relationship with our fans could be harmed for many reasons, including the quality of the experience at a particular festival, our competitors developing more popular events or attracting talent from our businesses, adverse occurrences or publicity in connection with an event and changes to public tastes that are beyond our control and difficult to anticipate.”

If for any reason the quality of a major festival such as Tomorrowland is compromised, we are likely looking at the decline of electronic dance music’s first publicly traded company. Meaning, the stock might not be considered as a viable investment for a broker right now, but SFX will move forward regardless of public interest. The companies goal is to become a three hundred and sixty degree representation of ‘EMC’, from downloads on Beatport, to major media channels, and the world’s largest music festivals.

Read the descriptions of SFX’s Board of Trustees, and there is no question that the company is a talent heavy, highly capable, powerful force, with the likelihood of massive success at festivals in the immediate future. But if this culture starts to creep back towards underground, independent, genre specific events, than SFX will be placed in a position to adapt. Easy enough for the star studded cast of executives, but the massive revenues they see today might disappear. Considering these are business oriented professionals, a lack of revenue might easily coincide with a lack of interest. This is not an immediate threat, or even five years down the line, but in ten years Sillerman will be seventy-four years old. Think he’ll still be interested in running a company focused on producing the best live festivals possible, for a culture that’s constantly scrutinized and associated with wavering morals and excessive drug use? A culture that he admittedly knows “nothing” about? Even though Sillerman is admit that SFX is not looking to sell in the future, it’s more than likely that he’ll pawn off what is left of the company when interest declines. Or in the very best case scenario dissolve the separate entities from the corporate title, hopefully allowing original leaders/owners to regain creative control. Ideally reinvesting the personal interest and sense of social responsibility that numerous promoters have been recognized for. There are many eggs in the proverbial basket now, and we should all hope that SFX doesn’t fuck this up.

i have a feeling he is going to fuck this up ;

should have bought stock six months ago

should have bought stock six months ago

You couldnt buy stock six months ago. And itll be interesting to see what happens

A ver que opinan?

Bring Hardcore shows to the U.S.!!!!

This is a great article. Don’t fuck it up SFX!